URGENT- Save Thousands On Your Taxes

Heyyy,

I just saved a client a minimum of $5k by asking their tax expert one simple question…should we elect S-Corporation status for 2023 ?

Maybe you’ve heard your friends talk about how they switched their business to an S-Corp or you’ve heard us mention on Instagram here and there?

This is one of the best tax strategy moves a business can make.

The deadline to file the S-election is tomorrow (although if you miss it there are ways to file a late election.)

A general rule of thumb is that if you are netting $50-60K a year, it may be worth exploring making the switch. Stop, drop, and call your CPA. 🙂

As a bookkeeper or CFO, we might not be filing the tax returns, but we want to make a difference and add value!

We talk about switching your business to an S-Corp frequently because one of the main benefits of switching your business to an S-Corp is…. you guessed it—all those tax savings!

Being taxed as an S-Corporation comes with additional costs, but if your CPA is any good they can calculate the tax savings and compare that to the added cost to see if the S-election makes sense.

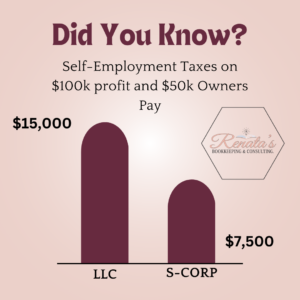

For my client, her profit was $111k last year (and we expect it to be the same if not more for 2023.) It makes sense to make the S-election in her case. She will now be added to payroll and paid $50k salary from the business. What does this mean? This means that instead of self-employment tax being calculated as 15.3% of her entire profit, it will only be 15.3% of her salary! You can do the math on the savings!

On average, switching to an S-Corp can save you up to $22,000 per year per owner!

If you’re thinking, “I’ll fill out all the forms you need from me for an extra $20k+ in savings each year.

We also offer payroll when you are ready to make the commitment.